Brian Dzyak

-

Posts

1,507 -

Joined

-

Last visited

Posts posted by Brian Dzyak

-

-

North Carolina Film-TV Incentives Sliced Amid Conservative Tide

North Carolina legislators have ditched the state’s longtime film and TV incentives program amid a conservative push to cut back on such government support.

“We knew that this would be an uphill battle and we were cautiously optimistic,” said Johnny Griffin, director of the Wilmington (N.C) Regional Film Commission. “The problem was that a lot of legislators were philosophically opposed to any incentives, period. So we were absolutely not surprised.”

North Carolina has been home to 800 productions over the past three decades.

TV series recently shot in North Carolina include CBS’ “Under the Dome,” ABC’s “Secrets and Lies” and Fox’s “Sleepy Hollow.” Recent movies include “Iron Man 3,” “The Hunger Games: Catching Fire,” “Tammy,” “The Longest Ride” and Relativity’s untitled heist drama about the 1997 Loomis Fargo robbery.

The state’s legislature decided to end North Carolina’s current 25% incentive program — which is covering about $300 million in production expenditures this year — and replace it next year with a grant program for movie and TV productions with a total annual cap of $10 million in grants.

That means the state will only be able to provide incentives to cover a total of $40 million in production expenditures in 2015. Griffin said North Carolina will probably see productions begin to depart at that point and the Motion Picture Assn. of America issued a statement predicting the new grant program will be ineffective.

“Under the current production incentive program, film and TV production supports over 4,000 jobs in North Carolina and brings millions of dollars in direct spending all across the state,” the MPAA said. “It’s disappointing that the new grant program included in the budget agreement will prevent North Carolina from remaining competitive in attracting this prominent source of in-state economic activity.”

The issue of using state funds to provide incentives for the film and TV business has drawn a concerted attack from conservatives since last year with the Americans for Prosperity group — backed by the Koch brothers — asserting that the incentives were not working.

“The film tax incentives are not proven job creators or overall government revenue enhancers, despite what proponents say,” wrote Donald Bryson, deputy director of the group in North Carolina, earlier this year. “In state after state, from Connecticut to Louisiana to Ohio, film incentives have been found to be net revenue losers.”

“And job creation?” Bryson added. “Iowa, Kansas, Missouri and Wisconsin have two things in common. All four have terminated their film incentive programs – and all four have lower unemployment rates than North Carolina, according to the federal Bureau of Labor Statistics.”

Bryson contended that the state needed to widen the tax base by eliminating targeted tax credits and cutting overall tax rates “instead of subsidizing its favorite industries with tax credits.”

North Carolina’s program — along with those in New York, Georgia, Louisiana and New Mexico — had been able to lure productions away from California, where an incentive program providing $100 million a year has been in effect only since 2009.

Legislation to increase the size of California’s program to $400 million per year is currently in the state Senate. Backers of the bill staged a rally this week at the state capitol, drawing several hundred supporters that included actors Carl Weathers, Daniel Stern and Ron Perlman.

-

Do you even understand one iota of the movie business?????????????????????????????

Please explain to me how many movies set all over the USA and the globe have been shot in Los Angeles!!! They have these things in LA called, wait for it, back lots. Giant sets that can re-create a number of different locations. So by your inane logic, a movie set in NYC cannot be shot on a lot on Hollywood, it must shot in NYC. A movie set in London must be shot in London, not LA, and so on and so forth.

R,

I never claimed anything of the sort in that word-salad you PRODUCED above. What I've clearly stated (because this is the way movies ARE made by anyone who's bothered making real movies that people go watch) is that when necessary, a production goes out on location to capture scenes that require an actual location that cannot be reproduced on a stage, on a backlot, or with VFX. After that, the production returns back to home base to finish out any stage and/or backlot work.

But that's not what happens anymore. Instead, productions seek out distant locations exclusively for the highest bribe being offered by States or nations. Sometimes, they even write scripts based on the locations handing out the bribes. And as we've seen in some cases, some productions even openly extort governments to get larger bribes than were offered before. (i.e. House of Cards)

That's the difference which resembles nothing like what you wrote above. So check that attitude a bit.

-

This one made me a little angry this week. Basically, NY screenwriters want NY taxpayers to subsidize their jobs so they can stay at home while making everyone else from LA commute to NY.

http://www.latimes.com/entertainment/envelope/cotown/la-et-ct-onlocation-new-york-tv-writers-20140813-story.htmlNew York TV writers want piece of state's production incentive

Writers who live in New York complain they're being snubbed by TV shows that film in New York but are written on the West Coast. And a group of high-profile writers wants New York to pass a new tax credit for productions that hire scribes locally.

The group hired a lobbyist in Albany about five years ago to start working on an amendment to the tax law. The team was advised to narrow its proposal to minorities and female New York-based writers in this initial stage, Fontana said, in order to "better speak to legislators" in the state.

The bill proposes a tax credit of up to 30% of compensation with a maximum of $15,000 for each New York-based writer that is a women or member of a minority group. The tax credit can't exceed more than $3.5 million a year, a portion that will be removed from the already existing $420-million rebate pool.One reason L.A. has traditionally been the main hub for TV writers is because studio executives prefer them to be nearby, Peterson said. Show runners also tend to live in Los Angeles, offering another reason to keep a writing room on the West Coast.

Lisa Takeuchi Cullen, a writer based in New York, is hoping New York legislators can push through the incentives. She considers herself lucky to have a deal to develop a pilot for CBS Television Studios.

"I know a very established TV writer who commutes to L.A. and she has children, and that's a tremendous hardship," Takeuchi Cullen said. "It's such a difficult job to get and a career to break into, and I think a lot of people will do anything it takes. I think that in this day and age there's no need for studios to insist that the only place that you can write a TV show is L.A."

-

Just saw this on Facebook:

Dues Paying Union Members Should NOT be removed from the Roster

http://petitions.moveon.org/sign/dues-paying-union-members?source=s.fwd&r_by=1512542Petition by cari Lutz

To be delivered to Contract Services-Los Angeles

Don t let Contract Services remove you from the Roster based on an outdated and discriminatory rule

Any I.A.T.S.E. union member who is up to date on their dues, should be eligible for union workThere are currently 700 signatures. NEW goal - We need 750 signatures!PETITION BACKGROUNDPlease show support with your signature! The Bottom LINE is that it is unjustified for Contract Services to remove dues-paying Local members from the Roster and force them to re-accrue hours as they did when they first joined.

Currently, Contract Services seeks to remove any union member who hasn't had five union days during a 3 year period because, supposedly, they appear "no longer to be in the industry" and all Rosters from the Los Angeles combined I.A.T.S.E. Locals are creating "an unwieldy paperwork problem" for their offices.

With this rationale, Contract Services is not taking into account individual circumstances (e.g. family issues, maternity leave, and health issues that are not considered disability) and is not serving the best interests of our members. They are also not taking into account that more and more jobs have moved out of California over the past five years. This kind of Roster set-up is archaic, outdated and discriminatory!

We need the voices of the current union members to be heard, and job opportunities to be available to them, as well as the continued support

and protection of our Locals. Contract Services should not be in charge of deciding the fate of our members. Please sign this petition. -

Pretty silly answer, movies are shot all over the world. Even though you find it impossible to accept this fact.

I'm shooting my next movie in South Africa. Why? Because that is where the story is set. I just returned from the location scout and I have to say I am very impressed with the people I met in the film community there. No wonder so many US shows are now shooting there. Oh and they also have a 35% tax credit, no unions, and a great exchange rate.

R,

We've been over this before. There's a distinct difference between shooting a movie in a story-specific location and choosing a location to manufacture your product based purely on who coughs up the largest bribe. That you can't acknowledge this difference either illustrates some level of ignorance on your part or an intentional unwillingness to publicly acknowledge the criminality of the system you are defending.

For instance, a movie that is set in New Orleans has justification to actually shoot in New Orleans. But a movie that is set in Los Angeles yet shoots in New Orleans only because of the tax bribe falls into the category I'm discussing.

-

Once again Brian you have distorted the facts on this topic, and so has this article to a degree. The show triggers a Louisiana state tax credit of $70, 000.00 per episode. 100% of this $70,000.00 does not go entirely to the cast line item. It goes to the entire budget which includes the entire crew, and secondary in state expenditures like catering. You have written this up to make it sound like the cast of the show is getting rich courtesy of the tax payer....not true.

Also, Louisiana uses a rather bizarre style of tax credit. The producer gets a tax credit, which he then has to sell to a corporation that owes tax, so that that corp can lower their taxes owed. This means the producers tax credit must be sold via a broker and may trigger a savings to the producer of 75-80% on the dollar. It's really a ridiculous system.

Ontario and Canada use a simple refund on the dollar system that pays the producer directly. There are no middle men, & if the tax credit is $500,000.00, then the producer collects $500,000.00.

R,

In other words, the taxpayers are unwittingly financing your movie and are not seeing any of the backend profits that you enjoy ON TOP OF the tax money you already extracted during production.

It's a brilliant system to funnel money to the top while making it seem as though labor is benefiting. They get jobs for a while then get taxed on that income...while you don't get taxed, get taxpayer paid subsidies, and don't have to share profits with your co-producing partners, the taxpayers. So taxpayers get the shaft on both ends, labor picks up the tab for the costs of running society, and you get to skate off with money upfront and all the profits later.

Nice work if you can get it. Fascism is truly taking hold with flags a'wavin' and trumpets blowing.

-

‘Happy Happy Welfare!’ Duck Dynasty Cast Makes $70,000 Courtesy of Louisiana Taxpayers Per Episode!

Everyone who is involved with Duck Dynasty, the popular A&E show that features rednecks engaging in the fascinating act of blowing on duck calls and doing other rednecky things to the enchantment of millions of ‘Murikans, is rolling in the bucks.

The 20 cast members make a total of $200,000 per show, or $10,000 each. Not bad money for wearing camouflage and playing in the mud, huh?

Well, as it turns out, much of that money comes from the state of Louisiana, as in taxpayer money. How much? Try $70,000 per show.

That’s right… the “happy happy happy” folks are laughing all the way to the bank and depositing YOUR money into THEIR fattening bank accounts – if you happen to be a resident of Louisiana, anyway. 35% of their weekly income comes from Louisiana taxpayers, thanks to an incentive program enacted in 2002 designed to entice film producers to make movies in the state. So many of them have taken advantage of the generosity handed out by the state that Louisiana is now dubbed, “Hollywood South”.

Hey, never mind taking care of the poor people in the state, right? After all, Louisiana has the second highest poverty rate of any state in the union.

But, you ask, is the incentive program making the state any money? After all, sometimes you have to spend money up front in order to make money later. That’s the nature of most any venture out there, whether done publicly or privately.

The answer to that question is a resounding “no”. Louisiana recently conducted a study which, according to Inquisitr, found only 15 cents of economic benefit for every dollar spent by state taxpayers are used to prop up Hollywood productions, including reality shows such as Duck Dynasty.

Furthermore, the incentive program has a history of bribery and corruption in Louisiana.

Offering these incentives amounts to pouring money into a black hole, only in the case of Duck Dynasty, they are making out like bandits. Not only are the cast members making a third of their incomes from taxpayer money, they are also making money off of the publicity they have received.

Take their duck calls, for example, the product that made the Robertson clan millionaires in the first place. As Eonline reports:

Last year (2012), they sold 60,000 of their Duck Commander callers. This year, they are projected to sell over 750,000, and at an average price of $59.72 (they range from $19.95 to $179.95), they are set to make—wait for it—$44,790,000 on their duck calls in 2013!Not to mention that Phil and Willie Robertson have each written books that so far has amounted to tens of millions of dollars in gross sales. And you can’t venture into a Wal-mart these days without seeing Duck Dynasty apparel and accessories – either for sale, or being worn by the customers.

We’re not begrudging the Duck Dynasty empire for making money. It’s the free enterprise system, after all. But there is something grossly wrong with already well-paid cast members and filmmakers profiting in part off of the taxpayer’s backs, and it is a microcosm of what is wrong with our capitalist economic system. Because of incentives like this, the wealthy continue to become wealthier, while many of the rest of us struggle just to put food on the table and pay for housing.

All during a time when one political party – the Republicans, of course – is trying to do everything they can to stop taxpayer money from going towards helping the increasing number of poor people in our country.

The Duck Dynasty cast owes much of their success to the taxpayers of Louisiana, who unwittingly have helped to fund their show and fatten their wallets. We’re just not too sure that Louisiana residents would be too thrilled if they were aware that they are losing big-time economically in this shell game.

Watch the chief economist for the state of Louisiana discuss the money drain that the incentive program for film and TV productions has been.

VIDEO on link: http://firebrandprogressives.org/happy-happy-welfare-duck-dynasty-cast-makes-70000-courtesy-louisiana-taxpayers-per-episode-video/

-

What are your potential clients asking for? What good is it to lock yourself into any specific equipment if you don't have clients who will ultimately help you pay it off?

I believe that the better strategy, particularly for a newcomer, is to sell YOURSELF and your skills first and foremost. You don't need to tell anyone if you have a camera or don't have a camera. That is entirely immaterial. What you do is sell yourself as a cameraman for whatever project you're after and when YOU determine what format and equipment is most applicable for THAT production, go rent it yourself from a rental house or pirate owner then rent it back to the production as if you owned it…with a slight increase in price. You put that profit away in a special account that will accumulate until the point when you want to buy something of your own.

This isn't like the days of film cameras where the technology was pretty stable and all that really changed was film stocks. Today's electronic cameras are almost constantly being one-upped by something new within months. Investing in one specific camera today risks obsolescence before you have the chance to pay it off. And having a specific camera also limits what work you're willing and able to do. You're more likely to only want to take jobs that use THAT camera so that you can pay it off and ignore paying jobs that won't use it. Turning down work because of equipment could severely limit your potential career advancement.

And if someone asks "What camera do you have?" simply shrug them off and just ask them what the project needs and tell them you have it. You getting work or not should have nothing whatsoever to do with the box you own at home.-

1

1

-

-

http://vfxsoldier.wordpress.com/2014/06/11/casualties-of-the-subsidy-trade-war-prime-focus-london/ Casualties Of The Subsidy Trade War: Prime Focus London

Tuesday morning I woke up early to do an interview with the BBC about the VFX industry. I argued that while the UK is benefiting from recent increases in subsidies for the film industry, I warned that Canada was offering much larger subsidies that pay 60% of labor wages.

A few hours later I get contacted by some people in the UK with indications that Prime Focus would shut down their London office after the email above was sent to employees. One would suspect the reason why an Indian VFX firm like Prime Focus would shut down operations in London was to ship more work to India but that was not the case. The email clearly confirms what I told the BBC earlier that morning: The subsidies in Canada are larger and US studios that receive them have demanded more VFX work be sent there.

For films that pass an EU mandated cultural test, productions can take advantage of a government subsidy that pays 25% on the first £20M and 20% on the rest of expenses in the UK that are capped at 80% of the total qualified expenses. What makes the UK subsidy very special is that it covers above the line talent salaries such as actors. So it’s quite probable that 20% of Sandra Bullocks $70M payday for Gravity may have been paid by UK taxpayers.

What’s not so nice for VFX is that the above the line talent and physical production costs can quickly hit that 80% expense cap which the Prime Focus email alludes to. While Canada doesn’t offer to pay above the line costs, they offer to pay the wages of VFX labor that have established residency. No caps, no cultural test, no other requirement that could be a big hurdle. So you can see why it makes sense to do your shoots in Louisiana, Georgia, and the UK where above the line talent is subsidized and go to Canada for VFX.

The Freight Train Mentality

In another part of my interview with the BBC I explained that many artists in the industry suffer from what I call the “Freight Train Mentality”. I’ve found that when it comes to subsidies many people ignore my predictions because it initially benefits them but when they finally get run over by the reality that some other location is willing to offer more or their subsidy program falls apart, they change their tune on subsidies.

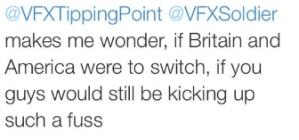

That realization became very apparent for a few people at Prime Focus London who were very much against my efforts. Just last week an artist called me out on twitter which I’ve posted a few snippets. I think it’s an important teachable moment:

It turned out the artist above was a PFL employee and admitted he had no idea how quickly things could have turned and retracted his statement. I told him no hard feelings. There were also staunch opponents who may have changed their tune also. If you remember some people were so motivated in derailing my efforts that they tried to find out who I was when I was blogging anonymously. The hope was that a threat of blacklisting would somehow intimidate me. Well even some of those people have come around after yesterday.

It turned out the artist above was a PFL employee and admitted he had no idea how quickly things could have turned and retracted his statement. I told him no hard feelings. There were also staunch opponents who may have changed their tune also. If you remember some people were so motivated in derailing my efforts that they tried to find out who I was when I was blogging anonymously. The hope was that a threat of blacklisting would somehow intimidate me. Well even some of those people have come around after yesterday.Some of them were people who not only acknowledged the subsidy race but endorsed it a while ago:

I am in London, and benefitting directly from these subsidies. I plan on going to Australia, New Zealand, and possibly Canada for work.I chose this industry precisely because it allows for international mobility.If the susbsidies are stopped what reason do California located film studios have for outsourcing work to far off lands like London or Sydney, with massive time zone differences and no appreciable gain in quality? None.So don´t count on my support for this anytime soon.The person who made the statement above was also a PFL employee. My guess is things quickly change when you fall in love and marry. Sorry that this happened to any of you but I hope you understand why I feel passionately about this issue and why it’s practically impossible to continue working in this industry with an expensive and permanent cycle of displacement.

A Facebook friend said it best:

You can tap dance around sympathy until empathy punches you in the face.Soldier On.

-

Where should it be shot?

R,

Where industry infrastructure exists with proper sound stages and indigenous crew. Duh.

-

Extortion paid for with another bribe.

The Netflix series “House of Cards” will shoot its third season in Maryland after reaching a deal with Governor Martin O’Malley.

Production company Media Rights Capital had threaten to leave the state because it looked like Maryland would fall short of meeting the same level of tax credits the show received in previous seasons, igniting a debate among lawmakers over the value of incentives. Some elected officials said that it felt like extortion.

The show will receive a total of $11.5 million this year — less than the $15 million the production company had been reportedly expecting, but apparently enough to stay in the state.

The series had delayed the start of season three to June as state lawmakers raced to come up with funding. Although the Maryland General Assembly earlier this month still came up short in boosting its tax credit program, O’Malley’s office said that they negotiated with MRC in the weeks since then to come up with the $11.5 package that includes productions credits and state budget grants.

http://variety.com/2014/biz/news/house-of-cards-maryland-filming-1201164393/ -

-

BUSTED: Tennessee Governor Offered Volkswagen $300 Million in Incentives to Reject UAW Union

Volkswagen workers who are employed at the Chattanooga, Tennessee plant had the right under federal law to vote on whether they wanted union representation or not, without intimidation, fear or coercion.

So it was somewhat surprising, on the surface, when they voted down having union representation. Many of us smelled a rat, and rightfully so.

The “rat” in this case was a combination of anti-union groups associated with the Koch Brothers and Grover Norquist contributing millions of dollars to Tennessee Republican politicians, including their governor, Bill Haslam, and some good old fashioned bribery on the part of the governor.

Enticed by those millions in campaign funds from anti-union groups, Tennessee Republicans then carried out the process of intimidating the workers to vote down union representation, topped off by a $300 million offer of taxpayer dollars from Governor Haslam to Volkswagen that would allow the Chattanooga VW plant to expand – but only if the plant’s workers voted down union representation.

This charade was exposed by journalist Phil Williams of WTVF-TV in Nashville. This past week, he revealed confidential documents that may end up being the smoking gun, and could have far-reaching implications. The documents reveal the $300 million incentive offered by Haslam to VW.

Before the vote by the VW workers, Haslam both implied and denied that the incentives were attached to whether the plant had UAW representation or not. But, as the report shows, the incentives were “subject to works council discussions between the State of Tennessee and VW being conducted to the satisfaction of the State of Tennessee.”

You can see all the documents obtained by WTVF’s Williams here.

If the allegations are true that Tennessee Republicans coerced the outcome of the union representative vote, then that would be a violation of those worker’s rights, under federal law.

The bottom line is that this is the absolute worst of corrupt American politics. The anti-union billionaires like the Koch Brothers used their wallets to influence Tennessee Republicans to affect the outcome of the VW worker vote in their favor, combined with the governor essentially using $300 million in taxpayer dollars for ransom, all has the end result of curtailing worker’s rights and hurting their chances to improve their earnings, benefits, and health & safety.

In short, the big guys f*cked the little guys, and it was done in an illegal way.

-

I'm sorry to inform you Brian that your beloved liberals have been just as bad. Are you going to tell me that government tax incentives did not exist under Carter, Clinton, or Obama? Sorry, but all three have doled out billions to private industry via all sorts of programs.

The idea that it's all been carried out by republicans is ridiculous. Heck, your beloved democrats are the biggest supporters of film tax credits in the USA, it's usually republican governors that want to get rid of them. And you're on here blaming conservatives? Crazy talk.

R,

Clinton and Obama aren't Liberals. They are Center Right Conservatives.

Democrats aren't necessarily liberal either. Party affiliation has little to do with economic ideology.

-

http://www.buzzfeed.com/hunterschwarz/how-a-case-about-invisible-dental-braces-could-change-the-wa

The case attracted the attention of the Motion Picture Association of America and Google because of the implications it could have on whether digital file transfers are considered imports under the Tariff Act. Google said they were not, but in a filing, the MPAA disagreed.

In order to protect American industries that create content that is increasingly being distributed digitally, like films, music, and software, the MPAA said the commission needs to include electronic transmission in its definition of “articles” protected by the Tariff Act. It also noted the rise of piracy and other forms of illegal trade, particularly in other countries.

But the MPAA’s interest in protecting films from piracy could prove to be a weapon that could be used against it, said Daniel Lay, who runs the website Vfxsoldier and organizes protests for visual effects workers.

“If the MPAA is saying films are a tangible good, and those goods are heavily subsidized by a foreign government, the law allows us to put duties on that,” Lay said.

-

Um no that would be an extreme stretch. Business and government have worked together in North America and other countries for over 200 years, get used to it. You'll never stop it Brian I don't know why you waste your time?

In the time this thread has been running there are more tax credits for film in the USA not fewer. Why isn't your campaign catching fire with film workers?

R,

Well, for starters, I don't have a "campaign." I'm merely providing information.

For why more film workers aren't speaking up, I can't speak for them. Most just go with the flow and/or have bought into the concept that tax "incentives" are a net positive without really having studied the realities. So there is some willful ignorance that is prevalent, but that is nothing new.

And this Conservative drive for the past thirty years is WAY beyond "government and business working together." It's Corporate power infiltrating what is meant to be a government of, by, and for the People. In other words, it's Fascism. The Monied Interests are raping and eviscerating this nation under the guise of "freedom" and "the free market." Business has zero loyalty nor responsibility to the nation, the overall economy, to humanity, to freedom, or to democracy itself. Because of this truth, GOVERNMENT is not supposed to be "working with" business. Government is meant to regulate business and human behavior in order to promote the general welfare for the greatest common collective good.

The scales have moved to the extreme where business interests are all that matter and the needs of society are held up for disdain. And that is the ultimate truth of this "tax incentive" scam which funnels more money to the Monied Class who is hoarding an estimated $32 TRILLION in offshore tax havens (i.e., not "creating jobs!") while cities, States, and entire nations are gutted from the inside out due to the lack of adequate tax revenue from those who hold most of the capital. We used to have a thing called the Corporate Death Penalty which would be used to "kill" any business which had proven to be a net negative to the needs of the People. It's time to bring that back AND to prosecute the actual people who are in charge and make these destructive greedy decisions.

The way for "film workers" to combat this cancer can't be through joining the "tax incentive" game by whining to their own local government to fork over bribe money just for a few jobs. It's a much bigger problem than that as evidenced by the Boeing example. This demands a very large effort to go after Corporations on the charge of extortion and prosecuting complicit elected officials on charges of bribery. Clearly a very large and complicated legal battle that would rock the very core of "Reaganomics/Milton Friedmanism" and call Conservatives on every lie they've delivered since at least 1980.

-

Oh well at least now you see it's not just the movie industry, we are making progress. :D

R,

Um, yeah, when did I ever claim that it wasn't? What are you feeling so smug about? You're the one defending worldwide extortion rackets and legalized bribery.

But at least you seem to finally be admitting that tax "incentives" are just extortion and bribery. So yeah, we are making progress. :D

-

Finally someone else is waking up. A story primarily about BOEING, but recognition that Corporate Extortion crosses industries:

http://www.latimes.com/business/la-fi-hiltzik-20140105,0,1097806.column#axzz2pcytc7aN

Here's a business practice likely to keep booming in 2014: corporate extortion.

We don't mean extortion of corporations, as is practiced by Somali pirates or entrepreneurial Russians. We mean extortion by corporations.

In this field the victims are taxpayers, and what makes it a beautiful business is that the taxpayers think they're getting a great deal, even as they're led to the shearing. And a lucrative shearing it is, for business: By the estimate of the Washington-based Institute on Taxation and Economic Policy, state and local tax incentives funnel $50 billion in tax revenue into corporate coffers every year. On a national basis, ITEP says, this is worse than a zero-sum game: The incentives are "much more likely to reshuffle investment between geographic areas than … to spur genuinely new economic activity."

…..

Still, politicians' faith in the magic of industrial incentives is hard to shake. A perfect example is the film incentive, which has gotten etched into the tax code of dozens of states despite consistent evidence that the giveaways to movie and television producers cost more than they deliver in terms of economic development.

In California, where the Legislature is under pressure to expand the state's film incentive program as much as fourfold from its current budget of $100 million a year, no objective study has shown that the program produces more revenue than it spends. The only study to make that claim, by the Los Angeles County Economic Development Corp., was financed by the incentive-hungry Motion Picture Assn. of America. (Cannily, the LAEDC's study didn't disclose the MPAA's role.)

Even worse, as my colleague Richard Verrier recently reported, the film incentives have become the grist of a nationwide trade in tax breaks worth as much as $1.5 billion a year.

A Hollywood producer snags a few million in credits to shoot a picture in Georgia, Pennsylvania or Illinois, say, then sells them to a middleman who hawks them in turn to Kohl's, or Macy's, or Bank of America, or the power plant company Exelon.

The studio gets its money more quickly than if it had to wait for a tax refund. The buyers cut their state tax bills as much as 15%. The middleman makes a profit.

Everybody wins, its seems — except for taxpayers, who get hosed.

Such is the natural harvest of a system that hands out tax breaks, regulatory exemptions and other benefits to business just for the asking. You get to the point where no smart businessman will make a move without expecting a payoff. As long as politicians aren't smart enough to turn them away, why should they expect anything different?

-

Basically what's going on here is that taxpayers are footing upwards of 1/3 of a film's budget. So why aren't those taxpayers being treated like co-financiers/producers and receiving points upfront and points on the backend grosses? Because all that's really going on right now with this tax "incentive" scam is that Corporations (in and out of the industry) are getting away with paying little to no taxes which leaves workers in all sectors to foot the bills to pay for schools, roads, and other public expenses while those at the top get to hoard more wealth that they don't really need.

If the general public (particularly in Georgia and Louisiana) had any idea just how badly they were being fleeced by Corporate extortion that plays States (or nations) against others in search of the largest bribes disguised as "tax incentives," there would likely be a revolt. Unless the lure of "bright shiny objects" in the form of movie starts blinds out reality, that is.

Hollywood's new financiers make deals with state tax credits

Brokers take the credits given to studios for location filming and sell them to wealthy people and companies looking to shave their state tax bills.By Richard VerrierDecember 26, 2013, 5:30 a.m.

ATLANTA — Ric Reitz makes movies. He helped bankroll the Matt Damon thriller "Contagion," Clint Eastwood's "Trouble With the Curve" and the Robert Downey comedy "Due Date."

Reitz, an energetic 58-year-old, doesn't hang out at the Polo Lounge, red-carpet premieres or swank offices in Century City. Instead, he works out of a former cotton mill near Martin Luther King Jr.'s boyhood home, hustling for business at Chamber of Commerce dinners and Rotary Club lunches. Recently, he was looking forward to attending a meeting of prosperous chicken farmers.

Reitz is one of Hollywood's new financiers. Just about every major movie filmed on location gets a tax incentive, and Reitz is part of an expanding web of brokers, tax attorneys, financial planners and consultants who help filmmakers exploit the patchwork of state programs to attract film and TV production.

In his case, he takes the tax credits given to Hollywood studios for location filming and sells them to wealthy Georgians looking to shave their tax bills — doctors, pro athletes, seafood suppliers, beer distributors and the like.

"I've got a giant state of people who are potential buyers," he said. "It's the funniest people who are hiding under stones."

The trade benefits both sides. The studios get their money more quickly than if they had to wait for a tax refund from the state, and the buyers get a certificate that enables them to cut their state tax bills as much 15%.

About $1.5 billion in film-related tax breaks, rebates and grants were paid out or approved by nearly 40 states last year, according to Times research. That's up from $2 million a decade ago, when just five states offered incentives, according to the nonprofit Tax Foundation.

Film tax credits have become so integral to the filmmaking process that they often determine not only where but if a movie gets made. Studios factor them into film budgets, and producers use the promise of credits to secure bank loans or private investment capital to hire crews and build sets.

"You just follow the money," said Ben Affleck, the actor-director who said he would shoot part of his upcoming film "Live by Night" in Georgia. "What happens is that you're faced with a situation of shooting somewhere you want to shoot, versus shooting somewhere you'd less rather shoot — and you get an extra three weeks of filming. It comes down to the fact that you have X amount of money to make your movie in a business where the margins are really thin."

The credits and incentives can cover nearly one-third of production costs. In 14 states, there is an added benefit: They can be sold, typically enabling the filmmakers to get their money months sooner than if they had to wait for refunds. States that permit the sale of tax credits, including Georgia and Louisiana, are now among the most popular for location shooting.

Tax credit brokers like Reitz, although little-known outside the industry, play a key role in greasing the skids of location shooting. Reitz and his partner sold $1 million in credits in 2009, their first year in business. Their company, Georgia Entertainment Credits, did $15 million last year, and they expect to hit $30 million in 2014.

Most referrals come from entertainment industry attorney Stephen Weizenecker, whose clients include Viacom Inc. and Comcast Corp.

"He has been a great advocate for the industry," Weizenecker said of Reitz. "He gets buyers in the door."

Not everyone is such a fan. Hollywood's trade workers — the electricians, carpenters, caterers and others who work behind the scenes — have long complained that they've lost their livelihood as states vie for film business with ever-richer incentives. The number of top-grossing films shot in California has plummeted 60% in the last 15 years, according to a Times review of public records, industry reports and box-office tracking data.

Some economists question whether these programs create long-term benefits to the local communities they are supposed to help. The sale of tax credits, meanwhile, has triggered criticism that companies and people with no connection to the film industry are benefiting from film credits.

Selling tax credits is "a particularly bad public policy because they allow purchasing corporations to shelter income from something unrelated to their activities," said Lenny Goldberg, executive director of the California Tax Reform Assn.

Most states won't say who is buying and selling tax credits, considering it to be confidential.

Illinois and Pennsylvania are exceptions, and disclosed complete lists of buyers and sellers in response to public records requests from The Times.

In Illinois, location tax credit buyers included retailers Kohl's and Macy's, ketchup maker H.J. Heinz and Bank of America. About $40 million in credits were sold last year from producers and studios including Fox and NBCUniversal.

"There's value in these programs in that some film companies, particularly smaller ones, may qualify for a tax credit but may not be able to use it," said Nicole Garrison-Sprenger of U.S. Bank, U.S. Bank, which last year bought more than $11 million in Illinois state tax credits. "Rather than let those dollars go to waste, they sell the tax credit to a third-party purchaser such as U.S. Bank. As a result, the film company has the financing that they might not otherwise have for their production."

In Pennsylvania, energy company Exelon Corp. helped underwrite the Jason Statham thriller "Safe" by buying a $4.3-million tax credit (for the discounted price of $3.7 million). Other recent buyers in Pennsylvania included Apple Inc. and Richard Mellon Scaife, heir to the vast Mellon banking fortune. Scaife bought a $1-million tax credit for the Denzel Washington film "Unstoppable" for $900,000, cutting his taxes by $100,000, records show.

Pennsylvania's maximum 30% tax credit was a chief draw for producers of the 2012 drama "Promised Land." The film's creative team — producer Chris Moore, director Gus Van Sant and actor-producer Matt Damon — chose the state in part because it allowed them to sell a 30% tax credit.

Moore said he spent six weeks in meetings at his Los Angeles office and Universal Studios' Focus Features unit, where accountants laid out competing offers from New York, Massachusetts, Georgia, Oregon and Pennsylvania.

"It's like the wild, wild West with so many people promising you money," said Moore, who also produced "Good Will Hunting" and "The Adjustment Bureau." "If you have a $100-million Brad Pitt movie, you just call 15 different film offices, and you're going to have the governor calling you at home saying, 'Hey, man, here's why you should do it in Iowa.'"

Georgia was appealing because its credit covered actors' salaries, but the "look" wasn't right for the story. The filmmakers considered Oregon, but the state's 20% cash rebate wasn't competitive.

New York had a stronger credit, but skilled workers were not available upstate, where the producers wanted to film. That would mean importing a crew and paying their housing and transportation costs.

Ultimately, Moore and his partners chose a town near Pittsburgh. They could hire local crews and get $3.3 million in state tax credits. The credits were transferred in May to Comcast, owner of Focus Features.

Companies and wealthy individuals typically learn about the credits from their tax attorneys, accountants or financial advisors.

Along with cutting taxes, buyers say it's also a chance to promote economic growth in their own states.

Bryan Marshall, who owns an industrial equipment distribution company in Lawrenceville, Ga., said he saved $18,000 in taxes by buying a $150,000 Georgia film tax credit.

"It was a no-brainer in my situation," Marshall said, adding: "It's been great for Georgia to get some of that California money."

Reitz and partner Wilbur Fitzgerald began selling tax credits shortly after Georgia sweetened its tax incentives in 2008.

The men got to know each other working as character actors on TV shows filmed in Georgia, including "In the Heat of the Night." They saw their livelihood threatened by other states offering richer deals to Hollywood and joined a coalition of state film industry advocates campaigning for more attractive incentives.

The expertise they gained researching incentive programs turned into a business.

"We'd get phone calls from practically every studio in America asking us about the tax plan and how it would work," Reitz recalled. "We said: 'Maybe we should become consultants and get paid for this.'"

State tax incentive programs vary, but most are structured knowing that film and TV companies based in California or New York don't have significant tax liabilities in other states. So they either pay a rebate after production is wrapped or allow the credits to be sold.

In Georgia, the tax credit is up to 30% of the money spent on production in the state (20% plus a 10% bonus for promoting the state). That includes not just location filming costs, but money spent on salaries for actors and crews and any costs for building sets. On a movie with a $100-million production budget, the state tax credit could be up to $30 million.

Georgia doesn't pay a rebate, so if studios don't have a tax liability there they must sell the state tax credit to gets its benefit. That reduces the value of the credit to the studio, because it must give a slice of the credit to the buyer and pay a commission to brokers like Reitz. So in the case of a $30-million credit, a studio that decides to sell it would net about $26 million, after broker fees and other costs.

Spending an afternoon with Reitz in his Atlanta office gives an insight into how the process works.

On this day, Reitz was working to sell off a $147,000 chunk of a multimillion-dollar tax credit Viacom was getting for filming a variety of movies and TV shows in Georgia. Viacom owns the BET, MTV and Nickelodeon cable channels as well as Paramount Pictures, which shot the movies "Footloose" and "Flight" in Georgia.

He had jotted down a list of half a dozen potential buyers on a yellow notepad, including an NFL player, a Middle Eastern investor, a Florida-based retailer and an oncologist, who had been referred to him by an accountant friend.

Reitz, wearing bluejeans and resting on a leather sofa next to an antique movie light, called the doctor first.

"Let me tell you what you're going to save," Reitz said, pausing to punch some numbers into his laptop. "I can get you 88 cents on the dollar," he said moments later. "We can knock this down by $11,000."

The oncologist didn't take long to give his answer. He agreed to wire Reitz $81,699. In return, the doctor will get a tax credit voucher with a face value of $92,840, which he can apply toward his 2013 Georgia state income tax bill.

Reitz, meanwhile, will earn a commission of 2%, or $1,857, for his short phone call with the oncologist. As is often the case, he'll split the commission with another broker who worked on the deal. After the commission and other fees, Viacom will end up with $79,842 from the transaction.

"In the early days, people were very skeptical," said Fitzgerald, Reitz's partner. "Now it's an easy sell."

Big deals can be lucrative. The going rate for, say, a $20-million credit would be $17.6 million before fees. Reitz and Fitzgerald would pocket a $200,000 commission, or 1% of the credit amount, and probably share some of that with others who worked on the deal.

Such large paydays are rare, however. A few minutes after his call with the doctor, Reitz got an urgent email from Weizenecker, the entertainment industry attorney. Viacom and TV One, a cable network co-owned by Comcast, had sold off more than $6 million in film tax credits to various investors but had $325,000 remaining. Did he have any buyers?

Reitz scanned his list of buyers and quickly called Weizenecker.

"I can commit them to a contract by tomorrow," said Reitz, whose authoritative voice has led to his being cast as TV judges, policemen and lawyers. "If you can scare up another $400,000 to $500,000 from Viacom, I can sell that just as quickly."

Although tax credits have been blamed for loss of production in California, they have been a boon for Hollywood's financial consultants.

Burbank-based Entertainment Partners, a big payroll-services provider, says it has handled the transfer of more than $200 million in tax credits for 100-plus projects since 2011. Most of the buyers are Fortune 100 companies.

Entertainment Partners has doubled to more than 800 employees in the last eight years, opening offices in Georgia, Louisiana, North Carolina, Utah and Alabama. Most of the employees work in Burbank, where a team of 18 workers advises companies on how to apply for, sell or monetize their credits. The company employed just one person to do that in 2006.

"We get 2,000 to 3,000 phone calls a year from clients," said Senior Vice President Joe Chianese, who launched the tax credit department.

The team draws up budgets and summaries of each state's incentives — eight budgets for a single film is not uncommon — while keeping tabs on any legislative changes that could affect film funding.

Entertainment Partners keeps a list of 25 companies that regularly purchase credits and has three full-time brokers who handle the sales.

"It's not just a phone call and handshake. There's a lot of work and discussion involved," Chianese said. "It can take weeks, it can take days."

Chianese also makes cold calls to prospective buyers and relies on leads from his staff, many of whom worked for major accounting firms with clients searching for tax breaks.

"Eight or 10 years ago it was, 'I want a beautiful mountain, should I go to Montana or Colorado?'" said Mark Goldstein, chief executive of Entertainment Partners. "Now it's, 'I can re-create anything. Just tell me where the money is.'"

Times researcher Scott Wilson contributed to this report.

-

Interesting pair of articles about Mauritius. Article one highlighting the tax breaks offered to attract Hindi film. Article two discussing how Mauritius is used as a tax haven for Corporations to escape taxation at the expense of everyone else.

Big shock. <rolleyes> Just need to replace the word "Scheme" with "SCAM."

http://www.thehindubusinessline.com/industry-and-economy/mauritius-offers-30-rebate-to-attract-bollywood/article5300723.eceMAURITIUS, OCT 31:Mauritius, known for its scenic beauty and exotic locales, has launched a rebate scheme to attract film makers, especially from Bollywood, to shoot in the picturesque island nation.

The Film Rebate Scheme allows for a 30 per cent refund on all the Qualifying Production Expenditures (QPPE) incurred by all film producers in respect of their projects in Mauritius.

This scheme puts Mauritius at par with other destinations like Malaysia and Abu Dhabi which offer a 30 per cent rebate.

The scheme was launched earlier this week by the country’s Vice Prime Minister and Minister of Finance & Economic Development Xavier—Luc Duval and Minister of Arts and Culture Mookhesswur Choonee, in the presence of Bollywood Actor Jackie Shroff.

“The (film) industry is estimated to bring MUR 1 billion annually in foreign exchange to Mauritius,” Duval said at the launch here.

It is also expected to generate employment for SMEs, designers, artists, hoteliers, with significant beneficial spill over effects on other sectors like tourism, trade, travel, transport and retail, he added.

The Board of Investment in Mauritius has recorded an increasing number of potential interests from local producers as well as production houses from China, South Africa and India. So far, expressions of interest have been received mostly by Indian producers.

Jackie Shroff said: “Mauritius should start producing movies. It should have a specialised school offering courses on script-writing and editing as well as crash courses on film making”.

As many as 198 films, commercials and serials from India have been shot in Mauritius since 1977.

MUR: Mauritius rupee

http://www.rawstory.com/rs/2013/11/02/deloitte-promotes-mauritius-as-tax-haven-to-avoid-big-payouts-to-poor-african-nations/Deloitte promotes Mauritius as tax haven to avoid big payouts to poor African nationsA global consultancy giant has been accused of advising big business, including UK firms, on how to avoid paying tax in some of Africa’s poorest countries.

ActionAid has obtained documentation showing that Deloitte, which employs more than 200,000 people in over 150 countries, has been advising foreign companies on how, by structuring their investments through the tropical island of Mauritius, they can enjoy significant tax advantages.

The charity claims that the strategy could help companies to avoid paying hundreds of millions of dollars in tax. Deloitte insists the strategy is not about tax avoidance and attracts much-needed investment to the countries involved.

A Deloitte document, “Investing in Africa through Mauritius”, passed on to the Observer, advises on investing in African companies via the island nation, which has a population of 1.3 million. The document provides the example of a foreign company investing in Mozambique, where more than 50% of the population live below the poverty line and average life expectancy is 49 years. Normally, the foreign company could expect to pay a withholding tax on the dividends flowing back to it from Mozambique of 20%. A sale of its Mozambique investment would see the company liable for a capital gains tax bill of up to 32%.

However, the Deloitte document explains that, if the foreign company made its investment through a holding company in Mauritius, it could limit the withholding tax it would have to pay to just 8%, while capital gains tax would be reduced to zero. The potential value of capital gains tax to developing economies is considerable. An Italian oil company was recently required by the Mozambique government to pay $400m (£250m) in capital gains tax.

The document explains that Mauritius could tax the holding company’s profits at 15%, but that this does not happen in practice. The firm explains that any tax liability in the island is wiped out by a foreign tax credit, issued because the company has been taxed in Mozambique.

Deloitte presented the document at a conference for international businesses two weeks before this year’s G8 conference in Loch Erne, Northern Ireland, when world leaders promised action to help impoverished nations improve their tax regimes. It followed claims by David Cameron that aggressive tax avoidance was “morally wrong”.

More than 80 major international organisations attended the conference addressed by Deloitte. Representatives from major banks and legal firms, including Clifford Chance, Citibank, JP Morgan, the World Bank, Standard Bank and several Chinese firms, were present.

Tax campaigners are increasingly concerned about how Mauritius is used by big business with interests in Africa. The island has taken steps to aggressively position itself as the “gateway to Africa” for companies looking to invest in the continent. It currently has 14 double taxation treaties in place with African countries and a further 10 under negotiation. But ActionAid said the terms of the treaties could easily be abused by companies seeking to minimize their tax bills.

The charity wants a global clampdown on tax avoidance, which it says costs developing countries hundreds of billions of pounds a year in lost revenue. It said that, if companies paid their fair share of tax, the money could be used to fund food, health and education programs. It cited the example of a British sugar company operating in Zambia. The money saved by the company through the legitimate use of tax avoidance schemes was enough to put 48,000 of the country’s children through primary school every year.

“The tax strategy advised by Deloitte could potentially be used to deprive some of the poorest countries in the world of desperately needed tax revenues,” said Toby Quantrill, ActionAid Tax Justice Policy Adviser. “In using the example of Mozambique to illustrate their strategy Deloitte chose a country where the average income is less than two dollars per day and one third of the population is chronically food insecure. Developing countries need to grow their tax revenues, which are vital to help lift people out of poverty. But that can only properly happen if large companies stop avoiding their taxes.”

A Deloitte spokeswoman said it was wrong to describe applying double tax treaties, such as that between Mauritius and Mozambique, as tax avoidance: “The absence of such treaties could result in a reduction of investment, and less profit subject to normal business taxes in the countries concerned.”

-

Louisiana movie tax credit reviewed by committee

http://www.nola.com/politics/index.ssf/2013/11/louisiana_movie_tax_credit_rev.html

By Julia O’Donoghue, NOLA.com | The Times-Picayune

A new state advisory committee will meet on Monday to discuss what, if anything, should be done to entertainment industry tax credits, including those given to the film industry, in Louisiana.

The state’s film production slowed for four to five months last year over concern that Gov.Bobby Jindal and the state legislature might cut or restructure the entertainment tax credits. That type of uncertainty isn’t good for Louisiana’s burgeoning movie and digital media industry, said state Sen. J.P. Morrell, D-New Orleans.

“The people who work in this industry need to have some security,” said Morrell, “We can’t have a situation where the industry is getting ready to do some movie projects and then they have to put everything on hold because they don’t know what is happening with the tax credits. That can’t happen year after year.”

Louisiana’s entertainment tax credit has been a sore point for several state budget experts, who say the tax breaks cost the state too much money. In 2010, the film tax credits cost the state nearly $170 million in revenue, according to a Legislative Fiscal Office report released last spring.

“We have to think about what it costs to have these programs,” said Greg Albrecht, chief economist for the Legislative Fiscal Office.

Morrell is supportive of the tax credit, but agrees that the costs of the tax program need to be controlled, especially as the credit becomes more popular.

“We have to stop it from ballooning with no end in sight,” he said.

-

I'd love to! :)

The avenue may be to attack the problem under extortion statutes. Production companies/studios are ostensibly using extortion techniques to pit governments against one another in order to extract the largest bribes from tax payers.

-

Since Brian loves to post all the studies that elevate his point of view that film tax credit programs do not benefit local economies. I guess it's time I start posting some of the many studies that show the opposite.

Ok let's start with Boston!

http://www.bostonmagazine.com/news/blog/2013/05/22/massachusetts-film-tax-credit-study/

R,

You're entitled to post all the propaganda you'd like, but real audits illustrate that claims of net gains are lies. Of course film commissions are going to claim benefits. It's their job to spew out whatever keeps them employed.

-

A film tax credit fiasco Tax incentives for movie and TV filming don't bring lasting benefits to the taxpayers who subsidize them. Worse, many such jobs get outsourced overseas.

By Michael HiltzikAugust 2, 2013, 6:24 p.m.

The movie "42" arrived in theaters this spring swaddled snugly in the American flag.

Studio marketers declared the film to be "the true story of an American legend." With good reason: It's hard to find a more uplifting sports story than Jackie Robinson's battle against racism on his way to becoming one of the greatest ballplayers in history.

"42" evoked its bygone era by filming extensively in Georgia, Alabama and Tennessee. The filmmakers collected millions in subsidies from those states' taxpayers, who proudly followed the production via local newspaper stories detailing its step-by-step progress from location to location.

And then the producers of this all-American story co-financed by American taxpayers recorded its soundtrack in London.

"It's a classic story of corporate greed," says Paul Frank, a spokesman for the American Federation of Musicians, which represents unionized musicians in the film industry. "Taxpayers are subsidizing the outsourcing of jobs."

The problem of "runaway production" — California's loss of shooting days to other states, largely due to the generous tax credits and other incentives offered elsewhere — is a staple of industry panel discussions.

But there's much less discussion about the impact of filmmakers' incentive-hunting on the business of postproduction, including music recording and digital effects. Many of Hollywood's franchise pictures are scored abroad, including the "Hunger Games," "Iron Man" and "Avengers" features.

Although AFM's contracts with major studios such as Disney,Fox, Universal and Warner Bros. require that the scores of those studios' productions be recorded in the U.S. at union scale, the contracts generally don't apply to studio subsidiaries or specialty film units such as Fox Searchlight, Universal's Focus Features and Disney's Marvel Entertainment.

Lionsgate, which produces the "Hunger Games" and "Twilight" movies, isn't an AFM signatory, and union officials say their attempts to reach an agreement have been rebuffed. They got the same cold shoulder from Legendary Pictures, the Wall Street-backed studio that brought out "42," whenthey objected to its plans to record music overseas after pocketing millions in taxpayer handouts. Lionsgate, Marvel and Legendary Pictures all refused to comment.

Hollywood's fretting about runaway production prompted the state Legislature to create a $100-million annual program to pay tax credits of up to 25% of California spending for some smaller-scale feature films and certain TV movies and series; last year the program, which originated in 2009, was extended through 2015.

But the postproduction parts of the business don't get any special help from the state program. Although in-state spending on music and digital effects by eligible productions is subject to the tax incentives, nothing in the rule book requires that these crucial functions be performed in California, or at least in the U.S. That's a change that the American Federation of Musicians thinks should be on the table.

"We've had lots of conversations about how to make postproduction a part of the incentive," said John Acosta, vice president of AFM Local 47, which serves most of Southern California.

The fact that the conversation is still taking place shows how half-baked the California program has been. Producers applying for the credit don't have to show that they would film outside the state without it. Productions are accepted into the program by lottery — first come, first granted.

And obviously no effort has been made to figure out which segments of the film industry are most at risk, and aim the money in their direction.

But those are typical flaws in the deeply flawed concept of film incentives. These tax-financed handouts are a mug's game in which Hollywood has played state legislators nationwide for suckers. More than 30 states pony up more than $1 billion a year in subsidies to lure star-laden productions, based on the fantasy that they're creating permanent job growth.

They're wrong. An objective study of Louisiana's pioneering incentive program found that in 2010 the state paid out $7.29 in incentives for every dollar in revenue brought in. "People are getting rich on this deal, and it's not Louisiana taxpayers," concluded the study's sponsor, the Louisiana Budget Project.

California's program, which was enacted as a defensive bulwark against poaching by the other states, doesn't pay its own way either, according to the state Legislative Analyst's Office. That nonpartisan body concluded last year that state and local tax revenue almost certainly came to "well under $1 for every tax credit dollar in many years."

That said, there's no question that film musicians need help. About 2,000 California musicians rely on film score work as their main source of income, according to Marc Sazer, head of the recording musicians caucus of Local 47. For a feature film they'll earn roughly $550 to $640 for a typical recording day comprising two sessions of three hours each. Producers pay an additional 10.9% into the musicians' pension fund and $48.54 per day for health insurance.

Although Los Angeles is still the world center of recorded film scores, it's lost ground to European locations, especially London. From 2000 to 2010, the number of the 100 top-grossing features with L.A.-recorded scores each year fell from 68 to 55, while London's share rose from 19 to 27.

Big money is hidden within those statistics: The "Twilight," "Hunger Games" and "Avengers" franchises alone account for tens of millions of dollars in wages, Sazer estimates, as well as foregone contributions to retirement and health benefits.

The trend toward recording offshore may not be due strictly to wage scales, which the AFM says are roughly comparable in L.A. and London. One difference is in residual payments for such secondary markets as home video and broadcast and cable TV showings. Under the U.S. contract the musicians divvy up 1% of the producers' gross license fees; in London, their share is nothing.

It's been suggested that the AFM could bring more recording home by giving up its residuals. "L.A. has to become competitive or in 10 to 15 years there will be no industry here," argues Richard Kraft, an agent for film composers (who aren't covered by the union).

Responds Dennis Dreith, a composer who oversees the AFM fund that collects residuals for the musicians: "Giving that up would be devastating in many ways." Musicians on a successful picture could receive income into their retirement years; Dreith says some are still collecting for "E.T. the Extra-Terrestrial," which was released in 1982.

As long as states compete with one another to hand over millions to movie moguls while cutting essential services for their own citizens, film incentives will continue to foster a race to the bottom.

California could be different, if it only aimed its fire where it's needed. As Dreith told me, "We shouldn't be allowing people to use our tax incentives to employ foreign workers."

Michael Hiltzik's column appears Sundays and Wednesdays. Reach him at mhiltzik@latimes.com, read past columns at latimes.com/hiltzik, check out facebook.com/hiltzik and follow @hiltzikm on Twitter.

STATE FILM SUBSIDIES: NOT MUCH BANG FOR TOO MANY BUCKS

in Business Practices & Producing

Posted

And no matter how many protections a state builds into its programs, experts argue that taxpayers and politicians never know what's happening inside corporate boardrooms. Companies can always threaten to leave to shake more money out of state governments — regardless of whether it really makes business sense to move, said Fisher, the tax incentive expert.

"The company still holds all the cards," he said."